Turn your crypto into action and yield.

Buy straight from your phone, automate savings, and deploy them for passive earning.

Same investment, higher return.

Avoid high and hidden trading fees. Stop letting your assets sit idle.

Get more

Invest 1000€, you get

Rebind

0.2693 ETH

BitPanda

-9.00€

0.2669 ETH

Revolut

-22.00€

0.2634 ETH

Coinbase

-45.00€

0.2571 ETH

Data collected on August 29, 2025, when ETH was priced at 3,688.20€

Grow faster

Attractive yield. No minimum deposit. No lock-up period.

Spark USDC

4.40%

Moonwell Flagship USDC

4.16%

Angle stUSD

0.00%As easy as ordering coffee.

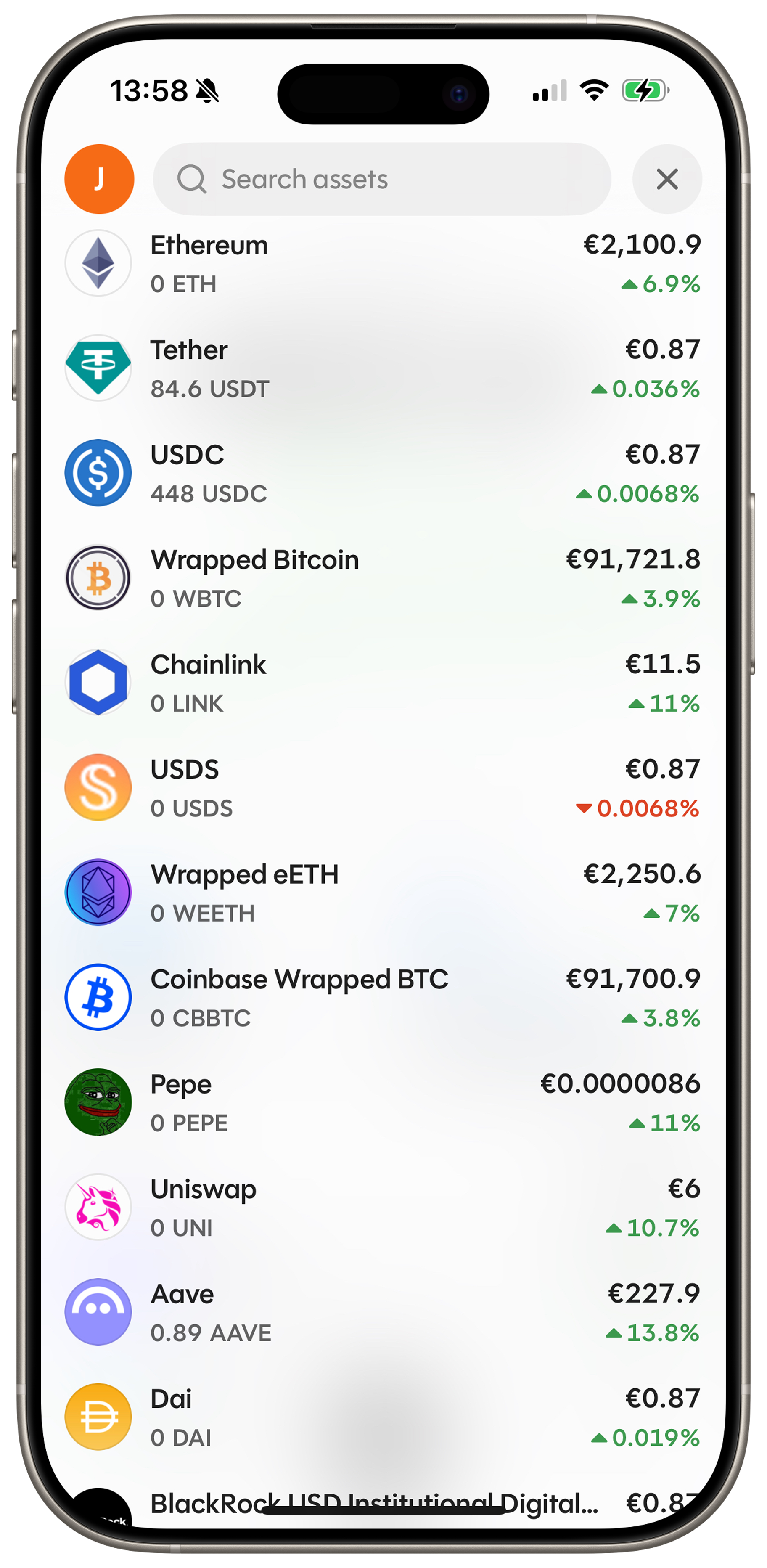

Use crypto as everyday money.

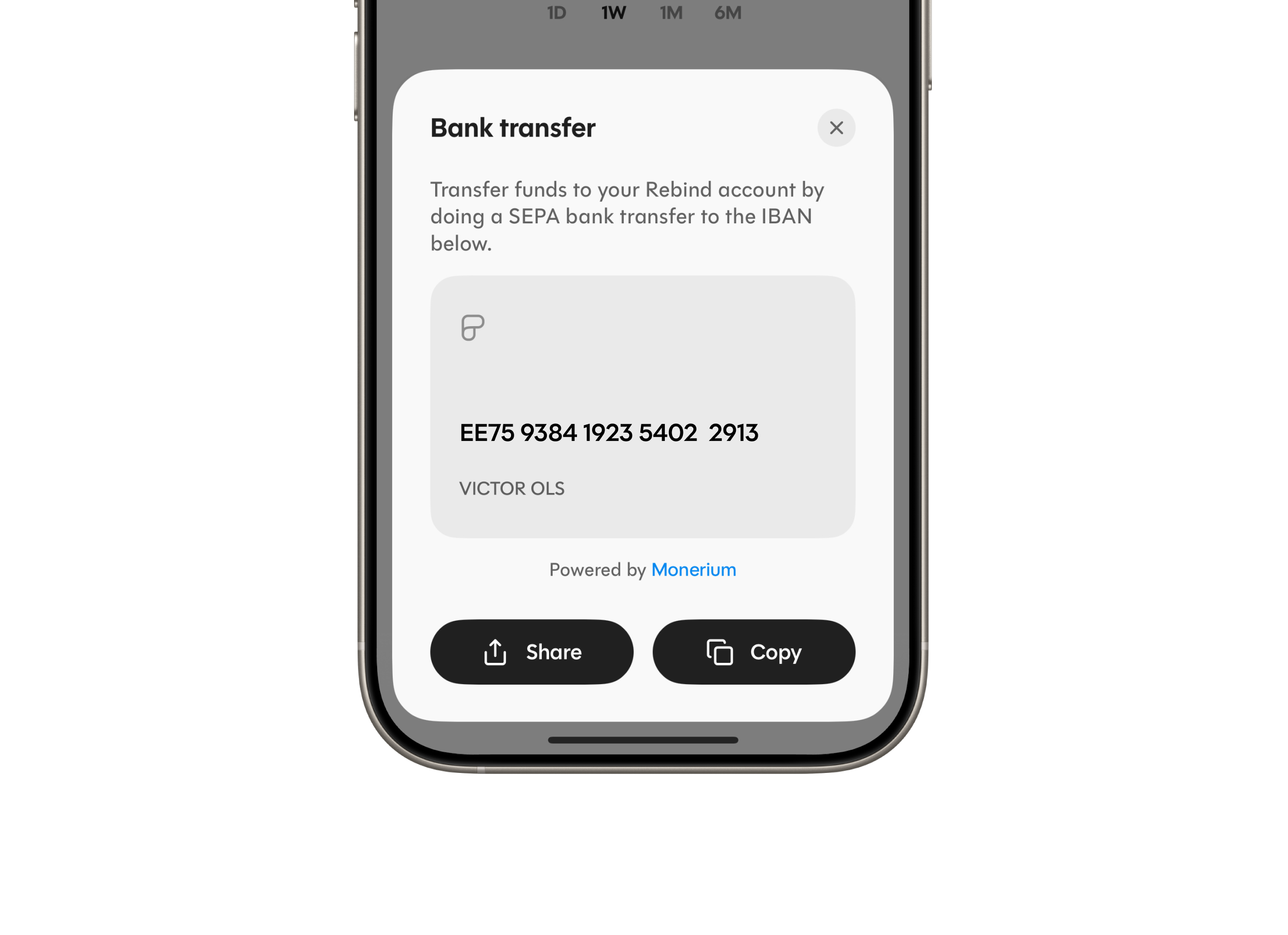

Personal IBAN

Receive SEPA bank transfers from anyone

Get EURe with 0% fee straight into your account

Instantly send EURe to any IBAN - no waiting time, no rejections, no fees.

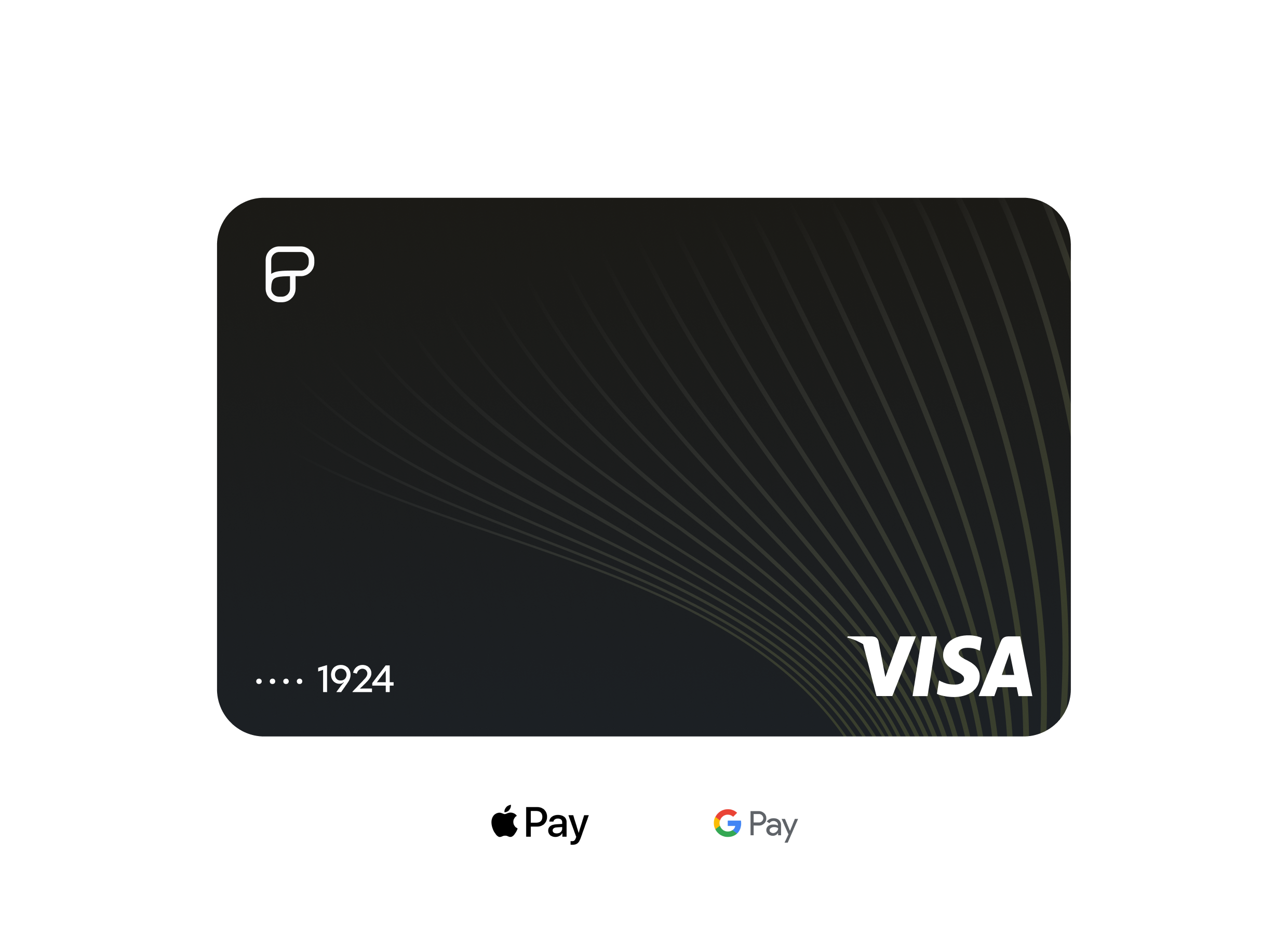

Virtual debit card

Spend stablecoins anywhere VISA is accepted

Earn up to 5% cashback when you use it

No FX fees or hidden mark-ups

Your crypto. Your control. Always secure.

Rebind is fully self-custodial and has no access to your keys or assets, forever.

Funds always 100% in control

Never be locked out. No account freezes ever. Only you have access to your funds.

Secure access, made simple

Log in with email or social account. Lost your device? Recover your wallet with your chosen method.

Don’t miss out – early spots come with special perks.

Sign up to our waitlist for exclusive benefits and early access.

Frequently asked questions

What is Rebind?

Rebind is a mobile app that lets you buy, send, spend, trade digital assets and earn passive yield on them - without middlemen. It provides seamless access to better asset prices and earning opportunities that were previously only available to experienced investors in decentralized finance. It comes with a personal IBAN and virtual debit card to also use crypto as your everyday money.How do I get started with Rebind?

Sign up with your social login, create your embedded self-custodial wallet, and deposit crypto from any exchange or wallet. Your account also comes with a personal IBAN, allowing you to use SEPA to deposit crypto directly from any bank account with 0% on- and off-ramping fees.Where does Rebind’s yield come from?

Rebind primarily generates yield through lending on secure, audited protocols like Aave, Morpho, Fluid, and others. These platforms enable users to earn interest from overcollateralized loans, ensuring that all borrowed funds are backed by more assets than are being lent out - reducing risk.What are the associated risks?

As with any financial product, risks exist, including smart contract and market risks. However, Rebind only integrates battle-tested protocols that have billions in deposits, have been extensively audited, and are trusted by institutions - offering a secure way to grow assets. Please read our Terms & Conditions also.Can I withdraw at any time?

Yes. No lock-ups, no minimum deposits. Withdraw instantly to any bank account, starting with as little as 1€.How is buying on Rebind cheaper?

Rebind automatically finds the best prices across decentralized exchanges, avoiding high fees from centralized platforms. This means better swap quotes, lower fees, and no hidden charges.Can I recover my account if I lose access?

Yes. You can back up your passkey to your device’s keychain (via iCloud or Google Cloud) to help recover your account if needed - ensuring you never lose access.How does Rebind handle taxes?

Rebind primarily leverages yield-bearing strategies with auto-compounding, which helps minimize taxable events. Additionally, Rebind provides an activity overview of all transactions, making tax reporting simple and transparent. As your account consists of a standard blockchain address, you can also paste it into your favourite tax reporting tool.Where is Rebind based?

Rebind is based in Paris, France, and operates in line with all local laws. This ensures a secure, compliant, and transparent experience for users.Which crypto can I spend with my debit card?

You can spend EURe, a euro-backed stablecoin (1 EURe = €1). Simply swap any cryptocurrency to EURe and top-up your card account to be able to spend instantly.What are the fees and limits of the debit card?

- Fees: No monthly subscription, or FX fees. No hidden mark-ups. Free ATM withdrawals up to 200€/month (or 5 withdrawals), then 2% (min. 1€).

- Limits: Up to 5.000€ per transaction, 8.000€ per day. ATM withdrawals capped at 250€ per transaction and 500€ per day.

Is Rebind secure?

Yes. Your assets stay in your control with self-custody and biometric security for multi-factor authentication. This means Rebind will in no case be able to access or move your funds. Rebind uses Privy (a Stripe company) for their embedded wallets. We integrate only audited, secure protocols and follow very high security standards.Can I recover my account if I lose access?

Yes. You can simply login with your chosen sign-up method again and also back up your passkey (multi-factor authentication) to your device’s keychain (via iCloud or Google Cloud) to help recover your account if needed - ensuring you never lose access.