Rebind Updates

Rebind Raises €1.6M Pre-Seed Round

Building a mobile-first finance app on open financial rails, starting with savings.

Steven Figura

Jun 26, 2026

3min

Over the last decade, fintech transformed how finance looks and feels.

Mobile apps replaced branches. User experience improved dramatically. But under the hood, most fintech products still run on the same legacy banking infrastructure as before. Innovation largely stopped at the interface layer.

That gap is what Rebind is built to close.

Today, we’re announcing that Rebind has raised a 1,6M€ pre-seed round, led by Greenfield Capital, with participation from Blockwall, and a group of business angels.

What Rebind is building

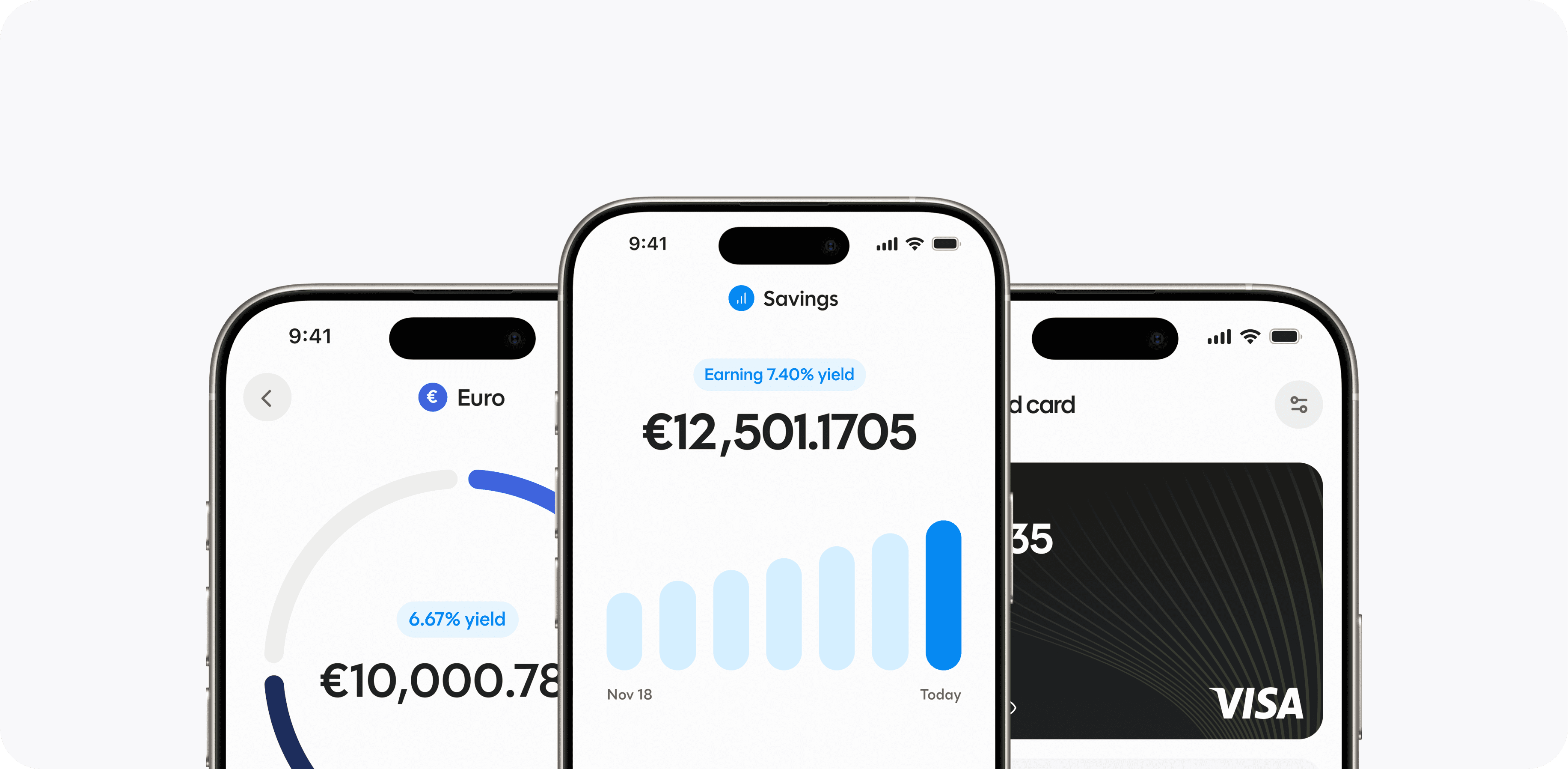

Rebind is a mobile-first finance app built on internet-native financial rails.

Unlike other consumer fintechs and traditional banks that route user funds through multiple intermediaries, Rebind provides a simple, familiar interface to directly access open financial infrastructure. This allows more of the value generated by money to remain with the end user, rather than being absorbed by layers of middlemen.

The product is designed to feel intuitive and accessible, even though the underlying systems are fundamentally different from traditional banking infrastructure.

Starting with savings

Rebind starts with savings.

Savings are the most widely used and most conservative financial product, and they clearly expose the limitations of legacy infrastructure. While money generates real value in the background, traditional savings accounts return only a small fraction of it to users.

By connecting savings directly to open finance protocols on the blockchain, Rebind enables more than 2x the returns than traditional accounts while keeping funds accessible at all times.

Why now

Open financial infrastructure has matured significantly in recent years.

Blockchain protocols that power global, real-time financial activity are no longer experimental, but already hold more than 30 billion euros in deposits and are integrated by global institutions such as Coinbase and Société Générale.

However, they remain largely inaccessible to everyday users due to their technical complexity.

At the same time, inflation and low interest rates have made the cost of idle savings increasingly visible. The gap between what money earns and what users receive has become harder to ignore.

Rebind exists to bridge that gap by combining modern financial rails with a product experience designed for everyday use.

What the funding enables

This pre-seed round enables Rebind to focus on building the core foundations:

Launch Rebind on iOS and Android

Expand core features to offer even greater convenience and control

Stay laser-focused on user needs, intuitive UX, and clarity

Deliver financial products powered by open internet-native rails, built for real people

Looking ahead

Savings are the entry point, not the end goal.

Over time, Rebind aims to become a broader financial interface built on open rails, designed for a world that is global, digital, and always on. This funding marks an important step in that direction.