What Rebind Is

A simple overview of what Rebind does and how it helps you earn more on your savings.

Steven Figura

·

Sep 11, 2025

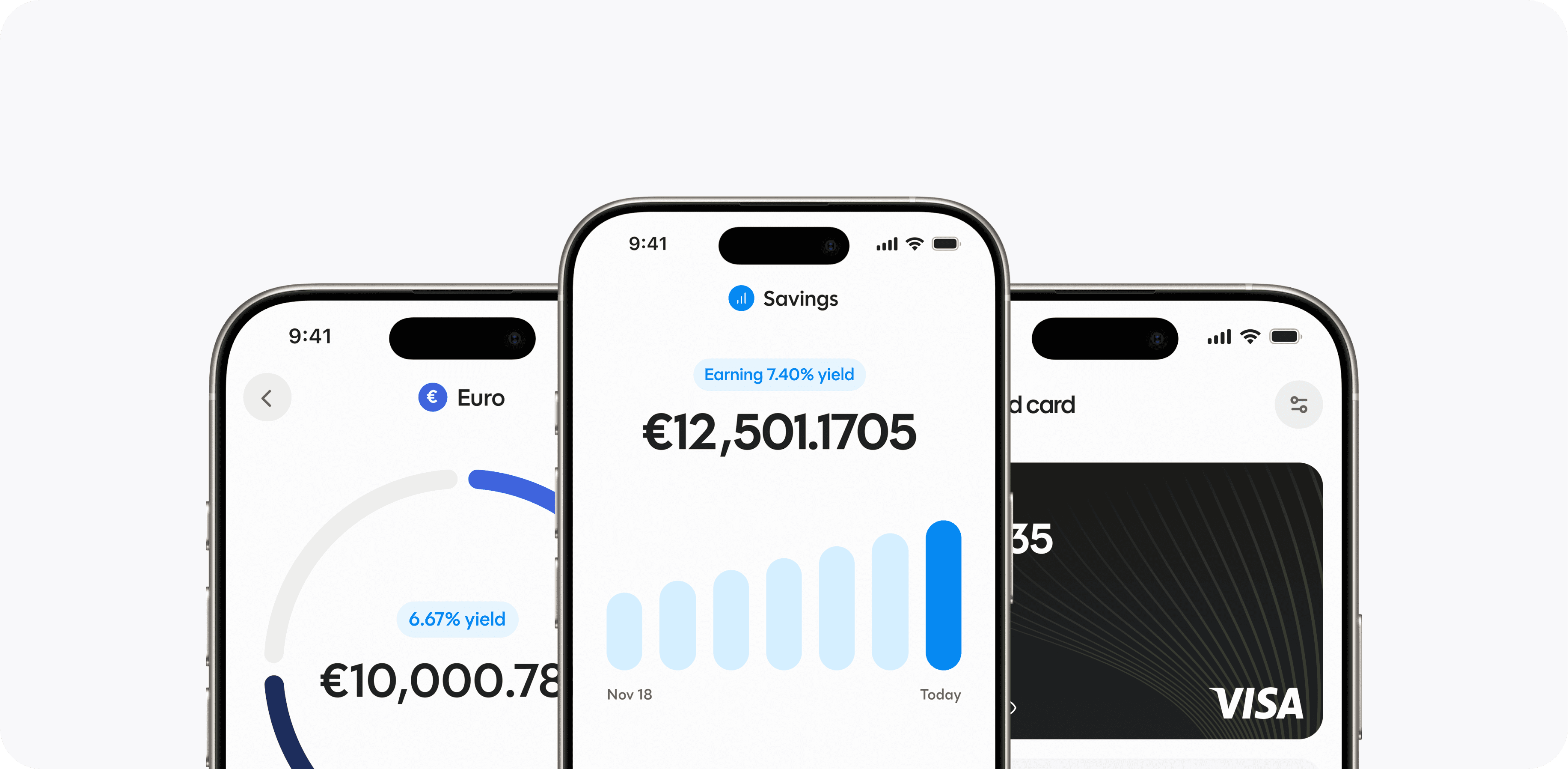

Rebind is a modern savings app that helps you earn up to 6 percent on EUR and up to 10 percent on USD by giving you access to efficient internet-native money markets. Your money stays accessible at any time.

Most savings accounts still run on slow and expensive infrastructure. Your deposits often earn value in the background, but only a small portion is passed on to you. Rebind exists to close this gap with a more direct and efficient model.

Instead of routing your savings through layers of intermediaries, Rebind connects you to open digital money markets. These markets match savers with borrowers in a transparent system where the rules are written in code. Because the process is automated and operates without middle layers, more of the value created flows back to you.

How Rebind works

A simple way to think about it is this. In the traditional world, you deposit money with a bank, the bank lends it out, the borrower pays interest and the bank keeps most of it.

Rebind lets you access a digital version of this idea in a more efficient structure.

Your money is placed into established open money markets where borrowers post high quality collateral (worth more than the actual loan) and borrow against it. Borrowers are willing to pay higher rates because the process is fast, flexible and requires no paperwork or long approval cycles. They also do not need to sell their assets, which adds convenience for them. The interest they pay becomes the yield you earn.

These markets already hold more than 60 billion US dollars in deposits and are integrated by global institutions such as Coinbase and Société Générale. Until now, they have been technically difficult for everyday people to use. Rebind makes them accessible through a simple and safe savings experience.

Why Rebind can offer higher yields

Traditional savings accounts pass through several layers before your money reaches borrowers. Each layer takes a share. As a result, the saver receives very little of the value generated.

Digital money markets connect savers and borrowers directly in an open and efficient system. Since the structure has fewer intermediaries, more of the value stays with the saver.

Rebind brings this model into a familiar app where your savings grow and remain available at any time. This is how you can earn up to 6 percent on EUR and up to 10 percent on USD without changing how you manage your finances.

Who Rebind is for

Rebind is designed for people who want:

Higher earnings on their savings than with traditional players

A simple and safe way to grow their money

Full access to their balance at any time

A modern financial product that is powerful, but easy-to-use

Whether you are building an emergency buffer or simply want your money to work harder, Rebind offers a straightforward way to earn more.

In short

Rebind helps you earn more on your savings by giving you direct access to efficient digital money markets through a simple and safe app.