Why Rebind Runs on Stablecoins

An introduction to stablecoins, how Rebind uses them, and why they are widely trusted.

Steven Figura

·

Nov 24, 2025

Stablecoins are digital versions of traditional money, such as euros or dollars, living on the blockchain. They are designed to always stay at the same value as their currency pair. One EURC is one euro. One USDC is one dollar. They allow money to move on modern, internet-native rails that work globally, instantly and around the clock.

Rebind uses stablecoins to let you participate in open money markets efficiently and safely. They are already used at massive scale by institutions, payment companies and fintech apps you already know.

This article explains what stablecoins are, how Rebind uses them and why they are a trustworthy part of your savings experience.

What stablecoins are in simple terms

A stablecoin is a digital token that always represents a real euro or dollar. It is backed one-to-one by cash or high-quality liquid assets held by the issuer. Because the reserves match the supply, the value stays stable and predictable.

You can think of a stablecoin as a digital cashier’s check.

For every token in circulation, there is real money held by a regulated financial institution.

Rebind uses only fully asset-backed stablecoins with long operating histories and deep liquidity:

EURe, issued by Monerium, an EMI-licensed institution in Europe

EURC, issued by Circle, a publicly listed and highly regulated company

USDC, also issued by Circle with independent monthly reserve attestations

USDT, issued by Tether, the most widely used stablecoin globally

These issuers safeguard billions on behalf of businesses, fintech platforms, exchanges and consumers worldwide.

Why the stablecoins Rebind uses are safe

Rebind selects only the stablecoins that meet strict criteria:

fully backed by cash or short-term government securities

audited or attested regularly by independent firms

issued by licensed or regulated financial institutions

redeemable one-to-one for the underlying currency

widely used across the global financial ecosystem

Circle’s public listing adds an additional layer of oversight and transparency. Monerium operates under European electronic money regulation. Tether publishes detailed reserve information and has been tested through multiple market cycles.

This means the stablecoins Rebind uses behave like traditional money, only on faster and more modern rails.

Where stablecoins are used today

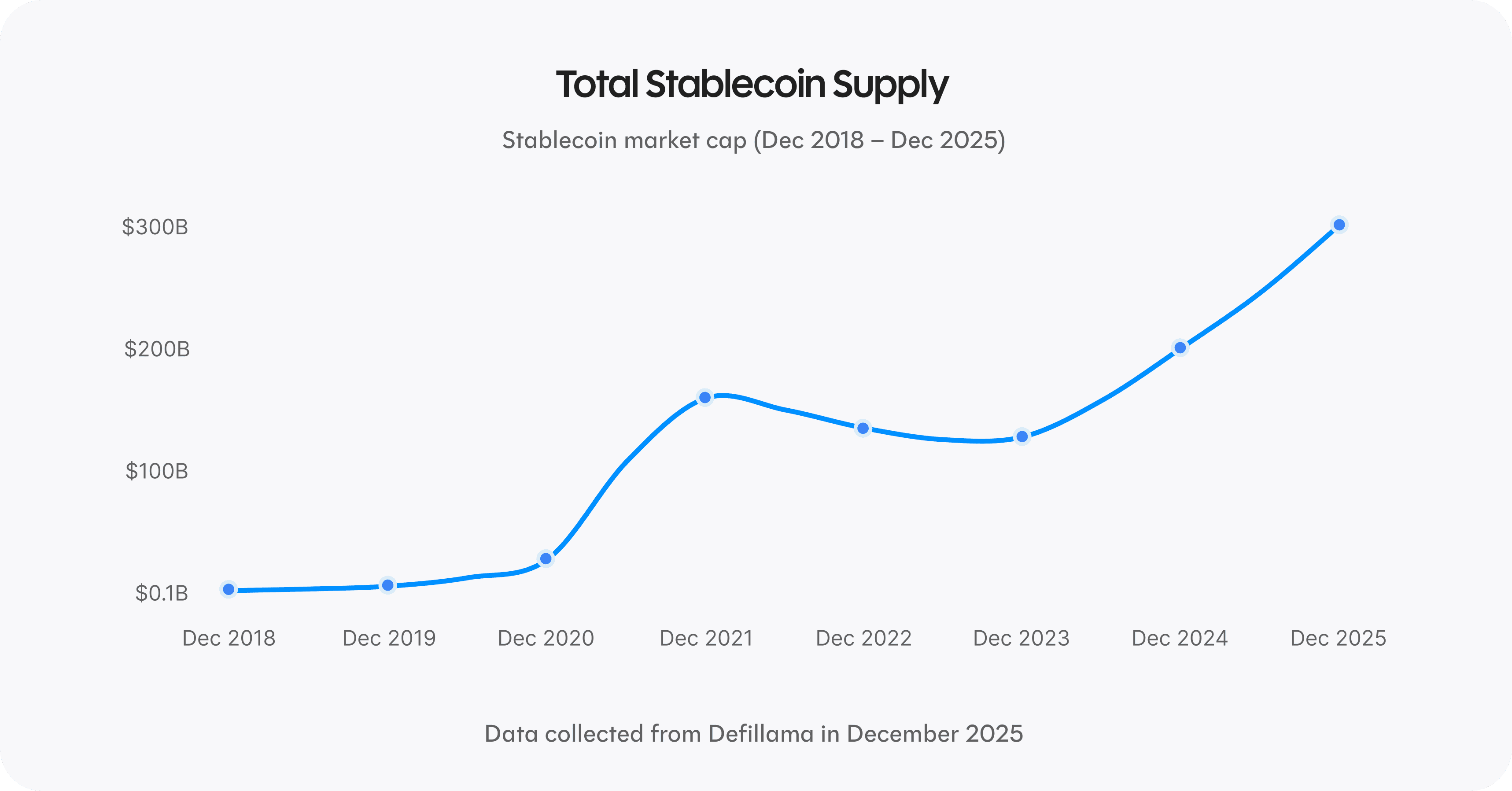

Stablecoins have become core financial infrastructure. They move trillions of dollars each year and often surpass Visa or Mastercard in daily transaction volume.

They are used by:

Revolut, for global transfers

Bitpanda, as payment and settlement rails

Klarna, to speed up merchant payouts

global trading venues and institutional pilots

Stablecoins are no longer experimental technology. They are a mature, widely adopted format for digital money.

Why Rebind runs on stablecoins

Stablecoins make modern savings possible by offering three key advantages.

1. Stable value

Stablecoins behave like euros or dollars. They do not fluctuate and do not expose users to currency risk. This gives Rebind a predictable foundation for savings.

2. Fast and reliable movement of money

Stablecoins settle in seconds, function globally and operate every hour of the day. This allows your money to move quickly and removes the delays of traditional banking.

3. Direct access to modern financial infrastructure

Stablecoins are the currency used in the large, established open money markets that Rebind connects to. They enable savings to grow efficiently while remaining accessible at any time.

In short

Stablecoins are digital euros and dollars backed by real reserves and issued by regulated, audited institutions. Rebind uses them because they are stable, safe and trusted at global scale. They allow your savings to move on modern financial rails and participate efficiently in digital money markets.